How to Properly Make an ACH Payment: A Simple Guide for 2025

Automatic Clearing House (ACH) payments are a crucial part of financial transactions for both individuals and businesses. Understanding the ACH payment process can bring forth significant advantages such as lower transaction costs and enhanced efficiency. This guide walks you through the process of making ACH payments seamlessly, ensuring your transactions are secure and effective.

Understanding ACH Payment Basics

Before diving into the ACH payment instructions, it is essential to grasp the fundamentals of ACH transactions. ACH is an electronic payment system used primarily for transferring money between banks. Whether you’re setting up ACH transfers for personal expenses or business ACH payments, understanding the system’s workings makes the process known as ACH payment setup more manageable.

The ACH Payment Process Explained

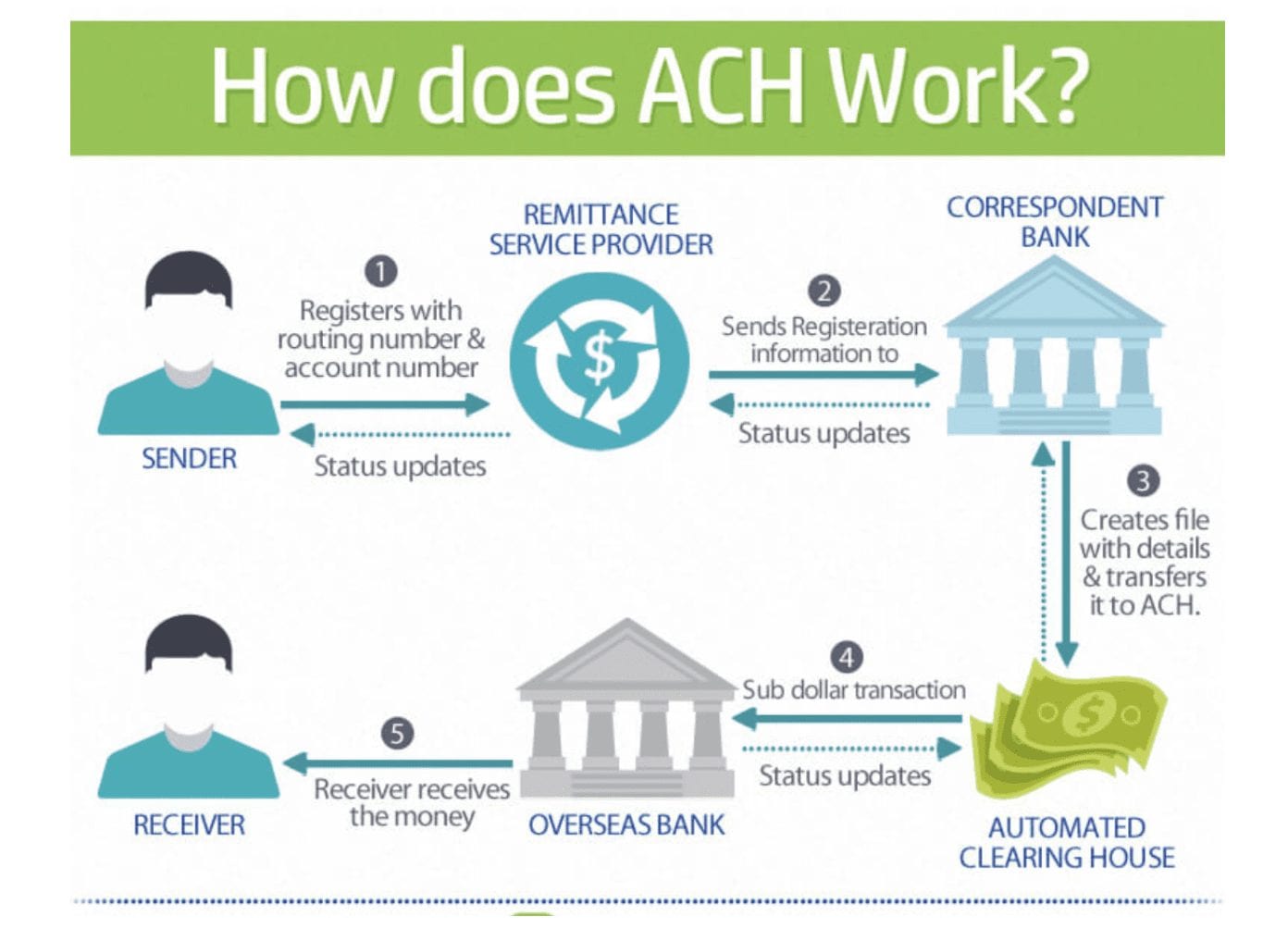

The key to mastering how to make ACH payments lies in understanding the step-by-step process involved. Here’s a quick overview:

1. **Initiation:** The transaction starts when the payee requests payment.

2. **Verification:** The bank performs a validation check for sufficient funds.

3. **Transmission:** The payment details are sent to the designated financial network (NACHA).

4. **Settlement:** Funds are transferred between banks, reflecting the payment in your account.

5. **Confirmation:** Transaction details are confirmed as a record of successful payment.

This detailed process ensures all parties are on the same page and promotes safe and secure electronic payments.

Incorporating ACH Payment Tools

Using ACH payment tools can significantly enhance your experience. There are various ACH payment processing software tools available that streamline the process. Tools enable features such as scheduling payments, tracking ACH payment transactions, and managing different payment methods all in one interface. While evaluating options, consider user-friendliness and integration capabilities with your existing financial systems.

Setting Up ACH Payments Successfully

To ensure a smooth ACH payment setup, you’ll need to follow specific instructions. It is pivotal for individuals to enable direct deposit for payroll or manage bill payments efficiently. Here’s how to proceed:

Gathering ACH Payment Details

Before initiating any payments, specific ACH payment details are fundamental:

– **Bank account number:** Where the funds will be drawn from or deposited into.

– **Routing number:** This identifies your bank during the transfer.

– **Authorization:** Obtain authorization from your payee to initiate payments.

Making sure this information is accurate ensures successful and secure ACH payment processing.

Common ACH Payment Methods

ACH payments come in various forms:

– **Direct deposit:** Commonly used for payroll and government benefits.

– **Bill payments:** Automate regular bills (like rent and utilities).

– **One-time payments:** Ideal for unexpected expenses or one-off services.

Understanding these different methods allows you to choose the most convenient option while fulfilling your ACH payment requirements.

Benefits and Safety of ACH Payments

Utilizing ACH payment methods comes with numerous benefits. Apart from cost-effective solutions, they provide enhanced security and flexibility. Transitioning from traditional bank transfers to ACH can result in:

– Lower transaction fees

– Speedier processing times

– Automated recurring payments

However, it’s also essential to be aware of the security measures necessary to protect your transferring data.

Protecting Your ACH Payments

Ensuring secure ACH payments should always be a priority. Here are some essential protection practices:

– Verify recipient details: Always double-check that bank account numbers and routing numbers are accurate.

– Use encryption: Employ strong encryption methods when submitting ACH payment information online.

– Regular monitoring: Regularly check account statements to identify any discrepancies or unauthorized transactions.

By enforcing these measures, you can mitigate risks associated with ACH payment fraud

Resolving Common ACH Payment Issues

Even with robust measures, sometimes, issues arise. Common ACH payment errors include incorrect routing numbers, insufficient funds, or misunderstood authorizations.

To solve these problems effectively:

– Recheck the transaction details and resend as needed.

– Contact your banking institution for assistance if issues persist.

By having a troubleshooting methodology, you can swiftly address any bumps along the way.

Key Takeaways and Practical Tips for ACH Payments

As you embark on your ACH payment journey, remember to:

1. Gather all necessary details before setting up payments.

2. Remain mindful of security protocols to safeguard transactions.

3. Choose the right ACH services that suit your needs—both personal and business.

Continual education about the process will ultimately pave the paths for efficient and smooth electronic payments.

FAQ

1. What are the main advantages of using ACH payments?

ACH payments provide several benefits, such as lower transaction fees compared to traditional bank transfers, automatic recurring payments, and faster disbursement of funds. They offer streamlined processes and significantly reduce the risk of physical checks being lost or delayed. Moreover, the security features inherent in ACH transactions make it a reliable choice for individual and business expenses alike.

2. How long does it take to process an ACH payment?

ACH payment processing times typically range from one to three business days, depending on the bank backlog and the nature of the transaction (one-time or recurring). For same-day ACH, initiated prior to the designated cut-off time, transactions may be settled on the same day, enhancing payment speed significantly.

3. Is it safe to use ACH for online payments?

Yes, ACH payments are generally safe when proper security measures are in place. Utilizing established encryption methods while confirming account information before submission drastically reduces payment fraud risks. Always be cautious and routinely monitor your transactions to account for any discrepancies.

4. How do I set up ACH payments for my business?

To set up ACH payments for your business, first organize your company’s bank account and routing numbers. Next, choose a reliable payment processing service and gather vendor ACH authorization forms to implement the payments. Finally, effectively communicate the procedures to your employees and ensure follow-up tracking for accuracy and efficiency.

5. Can I automate my ACH payments?

Absolutely! Many ACH payment solutions allow you to automate transactions, ensuring regular bills and payroll are paid on time without manual intervention. Setting up automatic transactions can significantly streamline your financial management, making payment processes more efficient and reducing the possibility of late payments.