Essential Guide to How to Pay Mortgage with Credit Card

Understanding Mortgage Payment Options

When navigating the complex world of homeowners’ finances, understanding the available mortgage payment options is crucial. One increasingly popular technique is the ability to pay mortgage with credit card. This strategy opens up various avenues for effective financial management, potentially offering rewards and flexibility to manage debts. It is essential to explore the ramifications of using your credit card for these payments—from fees and interest rates to benefits and risks. Homeowners savvy in their approach can make strategic decisions that might ease the burden of mortgage payments. As we delve deeper, we will cover the pros and cons of such payment methods, ensuring you are informed and ready to make the most suitable choice for your unique situation.

Can You Pay Mortgage with Credit Card?

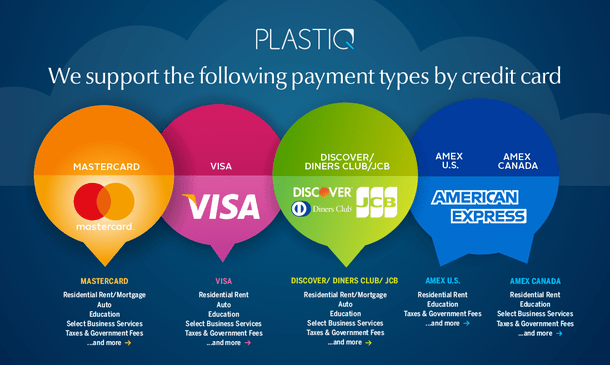

Many homeowners wonder, can you pay mortgage with credit card? The short answer is yes, but it depends on your lender and the methods employed to facilitate this process. Some mortgage companies may not directly accept credit cards, but there are alternative services that act as intermediaries, enabling you to make credit card mortgage payments. This method often involves a third-party service that allows you to pay your mortgage with your credit card for a fee. It’s vital to research the different mortgage payment services available and consider their associated costs, as they can vary widely. With careful attention to how these services work, homeowners can leverage credit card usage to make their payments easier and more rewarding.

Benefits of Using a Credit Card for Mortgage Payments

One prominent component in discussing how to pay mortgage using credit card is understanding the potential benefits involved. Among the most appealing advantages is the possibility of earning credit card rewards—such as cashback or points—that could be redeemable for future expenses. Moreover, utilizing a credit card can provide homeowners with flexibility in managing mortgage bills and cash flow, especially in months when extra funds are needed to cover unexpected expenses. However, it’s essential to be mindful of the credit card interest on mortgage payment if you’re not disciplined in clearing your credit card balance promptly. By assessing both the perks and potential downsides, homeowners can effectively weigh their options in the realm of mortgage payment flexibility.

Exploring the Mortgage Credit Card Payment Process

Knowing how to navigate the credit card mortgage payment process is crucial for homeowners considering this option. This approach typically involves selecting a reliable third-party service that processes credit card payments for mortgages. Homeowners using these services can make their payments online, thus enjoying the convenience of doing so from home. However, they should also consider the credit card fees for mortgage payments and whether these fees outweigh the benefits of maxing out their credit card rewards. Additionally, ensure to keep a close eye on the repayment schedule to avoid any defaults that could impact your credit score.

Payment Security and Options

When contemplating paying mortgage via credit card, it’s essential to consider mortgage payment security. Online transactions can pose unique risks; hence selecting credible services with credit card payment security measures is vital. Many credit cards come with built-in fraud protection that can protect your financial information during mortgage transactions. As a homeowner, utilizing these digital tools can provide additional confidence as you manage your payments. Understanding the nature of each credit card’s policies regarding transactions is crucial to maintaining financial stability while enjoying the benefits of credit.

Paying Mortgage with Credit Card: Pros and Cons

Understanding the pros and cons of mortgage credit card payments can aid homeowners in making informed financial decisions. On the pro side, making payments through your credit card can improve your credit score if payments are timely, thus leading to more advantageous interest rates for future financing needs. Moreover, the possibility of earning credit card cashback or points can provide a tangible benefit to paying such a substantial expense. Conversely, the downside might include potential overspending, accruing high-interest charges, and facing payment processing fees that negate any rewards earned. Each homeowner should carefully assess their financial habits and commitment to responsibly manage their credit card utilization.

Managing Financial Responsibilities and Moving Forward

For those learning how to pay mortgage using credit card, effective management of overall financial responsibilities becomes imperative. Crafting a well-thought-out budget that incorporates paying off credit card debt remains critical so as to avoid accumulating debt beyond manageable limits. Homeowners must balance expenses, ensuring they allocate sufficient funds for timely transactions while enjoying the additional flexibility that comes with using a credit card. Credit card management for mortgage entails monitoring your credit utilization ratio, ensuring it remains healthy, and understanding how your spending habits can have repercussions on overall financial health.

Financial Management for Mortgages: Steps to Take

Implementing a holistic approach to the financial management for mortgages will significantly affect your homeownership experience. Begin by periodically assessing your mortgage terms, and aligning them with your overall financial goals. By utilizing automated mortgage payments linked to your credit card, you can reduce the risk of late payments and enjoy the benefits of consistent use. Additionally, review mortgage payment calculators to anticipate future payment scenarios amidst fluctuating interest rates. By integrating automated tools with well-considered planning, homeowners can simplify their financial approach while benefiting from greater flexibility in debt repayments.

Insider Tips for Timely Mortgage Payments

Ensuring timely mortgage payments is essential for maintaining a healthy credit history. Homeowners can adopt strategies such as setting up alerts within banking apps to remind them of due dates. Moreover, linking key bills to rewards credit cards helps to not only cover debts but also bulk up points accrued—a win-win scenario if managed correctly! Employ regular assessments of all recurring payments and adjust your budget accordingly. Additionally, if inevitable financial challenges arise, explore options like mortgage payment assistance programs for additional support. Using thoughtful planning, you can significantly mitigate late payment risks and safeguard your financial wellbeing.

Utilizing Credit Card Offers for Mortgages

Homeowners have various options when considering credit card offers for mortgages. Some credit cards come with specific perks tailored towards homeowners, allowing you to benefit from lower interest rates or attractive introductory offers. Investigate cards that provide unique financing capabilities or a high rewards ratio specifically designed for substantial expenses like mortgage payments. Understanding the specific features of each card, including any additional benefits or drawbacks, can help you make audacious financial moves. By strategically utilizing these cards, one could potentially lessen mortgage repayments and harness credit card advantages for home loans.

Understanding Mortgage Fees and Interest Rates

Crucially, familiarizing yourself with understanding mortgage fees and interest rates for mortgage can prevent unpleasant surprises. These two elements prevail over the whole loan process, crucial for strategically engaging with payment methods—including credit cards. Scanning through fee disclosures could unveil significant opportunities to save money over time, whereas a keen understanding of fluctuating interest rates allows you to adjust your payment strategy for optimized results. Ensure to concentrate on minimizing costs while managing essential aspects of your credit card engagements.

Financial Planning for Homeowners

Careful financial planning for homeowners not only leads to stress-free home financing but can also elucidate potential savings on mortgage costs. With the landscape of mortgage and credit options evolving constantly, staying up-to-date on trends shapes better financial decisions for the long term. Evaluate all your payment methods thoroughly, and do not hesitate to shift to alternative payment methods if better prospects arise. Commitment to an informed financial strategy flourishes within understanding available options, guiding homeowners toward successful fiscal management.

Key Takeaways

- Understanding the benefits and risks of paying your mortgage with a credit card is essential.

- Managing timely payments is crucial to maintaining a healthy credit life.

- Leveraging credit cards wisely can provide flexibility and potential rewards for mortgage management.

- Conduct thorough research on various mortgage payment strategies to make informed financial decisions.

- Good financial planning and budget management are integral for homeowners aiming for successful mortgage payments.

FAQ

1. What are the main benefits of paying mortgage with credit card?

Paying your mortgage with a credit card can potentially offer benefits such as earning credit card rewards, like cashback or points that can be redeemed later. Additionally, this convenient method may help streamline payment processes using online mortgage payment credit card systems. However, it is important to consider any fees associated and maintain discipline in balancing your credit card payments to avoid debt accumulation.

2. Are there fees involved with using credit cards for mortgage payments?

Indeed, there are often associated credit card fees for mortgage payments, particularly if using a third-party service that processes mortgage credit card transactions. It’s crucial to thoroughly review these costs and consider whether potential rewards outweigh the fees. Always compare fees against traditional payment methods to evaluate the most cost-effective approach to manage your mortgage.

3. How can I ensure timely mortgage payments using my credit card?

To ensure timely mortgage payments, make use of automated payment systems linked to your credit card and set alerts or reminders. These small steps can prevent late fees associated with mortgage payments. Maintaining regular checks on balance and due dates also helps promote accountability, fostering a responsible credit card payment strategy that avoids interest accumulation.

4. Can paying my mortgage with a credit card impact my credit score?

Using a credit card to pay your mortgage can have both positive and negative effects on your credit score. Timely payments can improve your payment history, potentially benefiting your overall credit score. However, utilizing too much of your credit limit can negatively impact your credit utilization ratio, potentially leading to a score decrease. Finding a balance is essential to maintaining a good credit score.

5. Is there an alternative to using a credit card for mortgage payments?

Yes, there are several alternative mortgage payment methods, including traditional bank transfers, online payment portals through your bank, or using apps designed to assist with managing mortgage payments. Each option comes with its own set of features and potential benefits. Research thoroughly to find the solution that best fits your budget and needs.