How to Easily Transfer Cash App to Bank: Essential Steps for 2025

Transferring funds from Cash App to your bank account can bring significant convenience. In this guide, we will explore the comprehensive cash app transfer process, detail the best practices for making cash app withdrawal smoother, and highlight essential steps for linking your Cash App to a bank seamlessly.

Getting Started with Cash App Bank Settings

Before you transfer cash app to bank, it’s paramount to configure your cash app bank settings. Proper configuration ensures that the funds intended for withdrawal reach the correct account without any issues. To start, download the Cash App mobile app if you haven’t done this already and sign up or log in. In your Cash App interface, navigate to the banking tab to find options for linking a bank account easily.

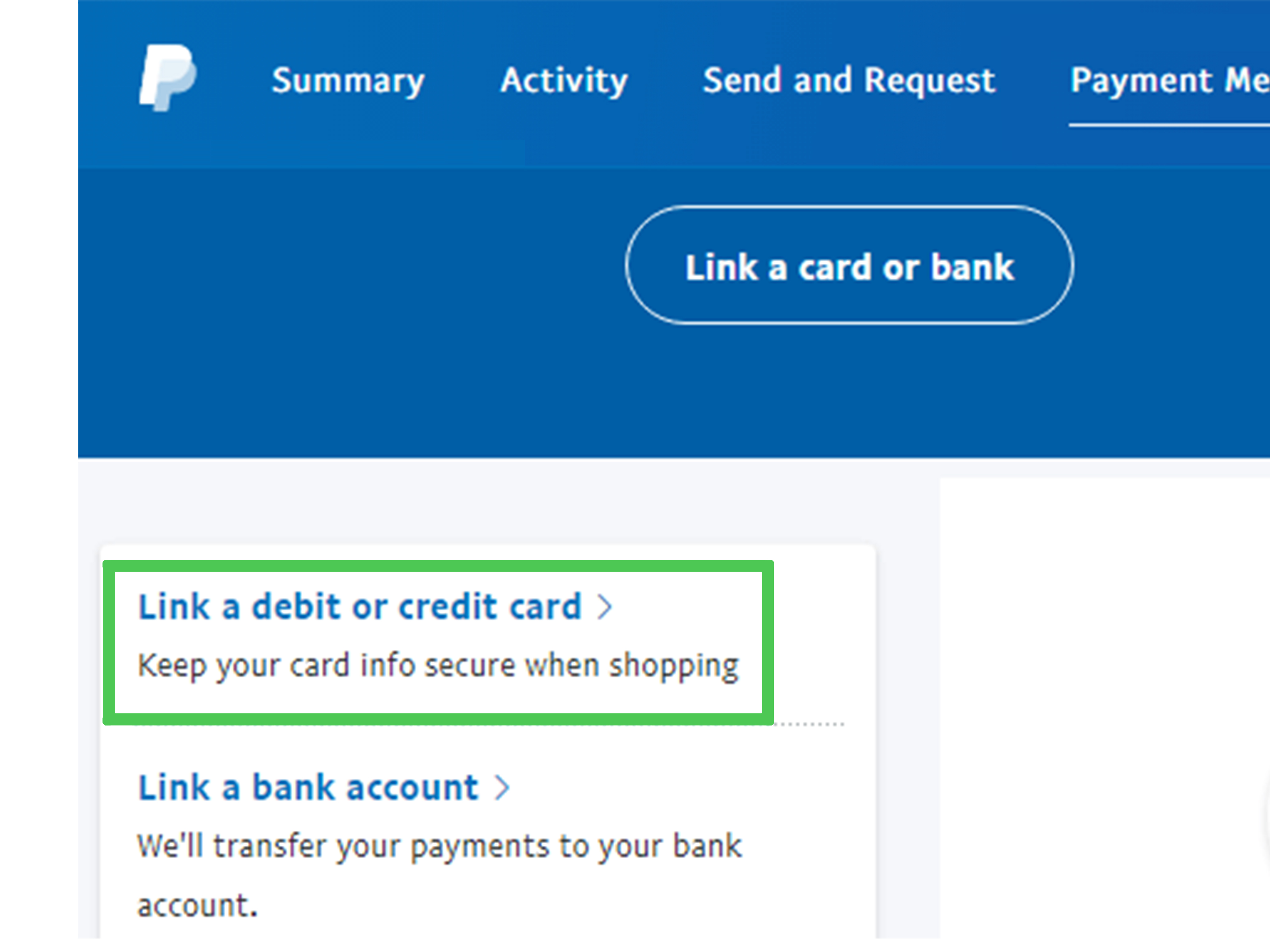

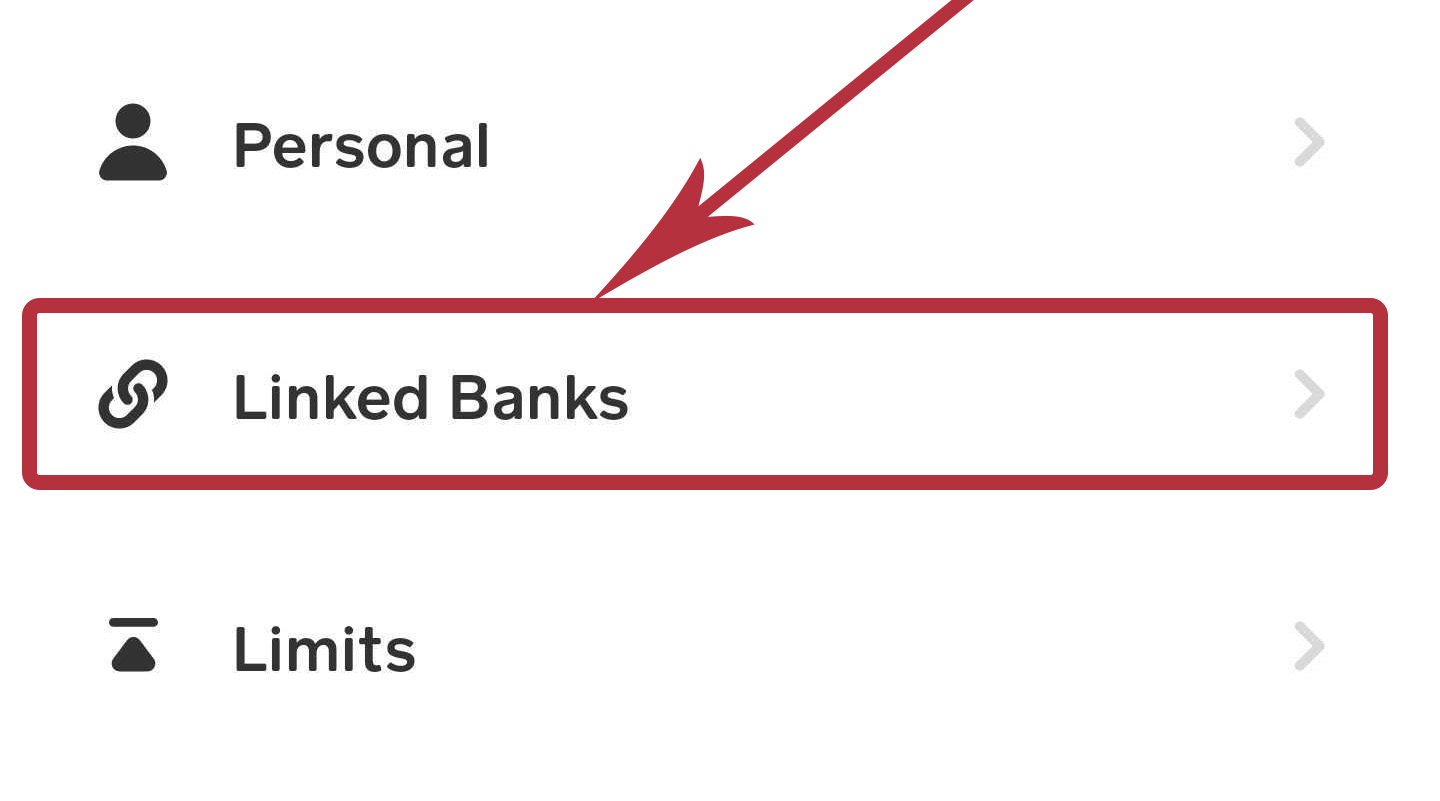

Linking Cash App to a Bank Account

Linking your cash app to bank account is quite simple. Tap on the banking icon on your Cash App home screen, followed by ‘Link Bank.’ You can select your bank from the list provided or gently type in your bank’s name to find it quickly. Cash App bank verification involves entering your bank account details with accurate information, such as your routing number and account number. Once you’ve completed this step, don’t forget to confirm these details to finalize the setup.

Understanding Cash App Direct Deposit Setup

One of the most beneficial features of Cash App is its direct deposit option. A direct deposit allows you to deposit your paycheck or other recurring payments directly into your Cash App account, eliminating the need for a physical bank visit. To set up cash app direct deposit, navigate to the ‘Direct Deposit’ section found in your account settings. You’ll be provided with a routing and account number to share with your employer for consistent payments. Make sure you check your cash app transaction history to ensure the deposits are made successfully.

The Cash App Transfer Process: Fees and Limits

Understanding the various cash app transfer fees and limits can help optimize your banking experience. Cash App allows users to make instant transfers, but these may come with fees. Generally, instant transfers permit faster access to your funds, but come with a fee of 1.5% of the transfer amount, while standard transfers are free but can take 1-3 business days. Make sure you’re familiar with your cash app transfer limits to avoid any inconveniences during withdrawal.

Executing a Cash App Withdrawal

When you want to make a cash app withdrawal to your bank account, it’s essential to follow these steps carefully. First, open your Cash App and click on the ‘Balance’ tab on your home screen. From here, tap the ‘Cash Out’ option and choose the amount you wish to transfer to your bank. After selecting an amount, confirm the transaction and select your preferred transfer speed—either instant or standard. Make sure to review your transactions should there be any issues; this may involve checking your account’s transaction history for any discrepancies.

Resolving Common Cash App Transfer Issues

Cash App users sometimes encounter challenges while transferring funds. Some common problems involve cash app linking issues or low transaction speeds. If you face any issues with the transfer process, first ensure your app is updated and that you have a stable internet connection. If troubles persist, reach out to cash app support for transfers or customer service for additional assistance. They can help troubleshoot issues and guide you toward an effective resolution based on your transaction history.

Optimizing Your Cash App Transfers

To ensure that you benefit fully from the app’s features, understanding how to optimize your cash app funds transfer is essential. Take note of transaction timing; transfers sent after business hours may not be processed until the following business day. Always consider your transfer amounts in relation to your daily limits, to prepare for larger financial transactions down the road.

Utilizing Cash App Cash Out Options

When it comes to cash-out options on Cash App, users can select between standard transfers to a bank account or instant withdrawals. The choice between these transfer methods largely depends on your urgency for the funds. While standard transfers are fee-free but slower, cash app cash out methods such as instant withdrawals signify speed, albeit with fees. Check your settings and preferences to ensure you are aware of which options are available to you based on your Cash App account setup.

Monitoring to Ensure Secure Cash App Transactions

Keeping track of your payment notifications and transaction records is key to managing your cash app effectively. Regular monitoring can ensure that you’re aware of any potential issues and help you optimize your operations using Cash App. Use your Cash App interface’s transaction tracking features, which provide a detailed history of all received and sent payments. This information is invaluable for transparency and personal finance management.

Summary and Key Takeaways

In summary, transferring from your Cash App to bank account can be a straightforward process. Here are a few key takeaways for successfully managing your transactions:

- Ensure your Cash App settings are correctly configured for bank linking.

- Be aware of transfer speeds and potential fees when using cash app withdrawal options.

- Monitor transactions closely to troubleshoot any issues that may arise.

- Utilize Cash App’s cash out options wisely based on your financial needs.

FAQ

1. How long does a Cash App to bank transfer take?

The duration of a cash app to bank transfer depends on your choice of transfer method. Standard transfers usually take 1-3 business days, while instant transfers are processed within minutes but incur a nominal fee.

2. What if my Cash App payment is pending?

If your cash app payment is pending, it may be due to insufficient funds, transfer limits, or bank processing times. Review your transaction history and ensure your account is in good standing.

3. Are there limits to how much I can transfer from Cash App?

Yes, Cash App has certain transfer limits based on account verification status. New users may have lower limits until verification is complete, allowing higher amounts as the account matures.

4. How can I troubleshoot Cash App transfer issues?

If you experience problems with cash app transfer issues, first contact cash app customer service via their app or website. They can provide guidance to resolve specific transfer challenges effectively.

5. Can I use Cash App internationally?

Currently, Cash App is only available for use in the United States. International users may need to look for alternative services to conduct similar transactions.