Smart Ways to Remove Paid Collections from Your Credit Report in 2025

Removing paid collections from your credit report can significantly improve your credit score and enhance your financial opportunities. If you’re looking for effective ways to navigate through collection accounts and ensure your credit reports accurately reflect your financial situation, you’ve come to the right place. This article will guide you through actionable steps, tips, and strategies for ensuring credit report accuracy and creating a plan for financial recovery. Whether dealing with debt collection agencies or exploring how to negotiate with debt collectors, we’ve got you covered.

Understanding Your Credit Report and Collections

Your credit report is a detailed summary of your credit history and financial behavior. This documentation is critical as it influences your ability to secure loans, credit cards, and even rental agreements. When collection accounts appear on your credit report, they can diminish your credit score. Therefore, gaining a comprehensive understanding of what your **credit report** entails and how **collection accounts** affect it is crucial for taking steps to **remove paid collections**. Begin by obtaining a copy of your report from the national credit bureaus to identify any negative items that need your attention.

Impact of Collections on Credit Score

Having collections on your credit report can have a lasting impact on your overall financial health. Effectively, these **collection accounts** can lower your credit score significantly — sometimes up to 100 points. This drop occurs because credit scoring models view collections as indicators of missed payments and financial instability. Consequently, understanding the nuances of how **paid collections** affect **credit reports** is essential. Consumers need to see how even paid collections can stay on a credit file for up to seven years if they are not disputed correctly. Therefore, addressing these items through **dispute credit report** procedures when applicable can lead to a cleaner credit history.

Dealing with Creditor Communication

When managing collection accounts, effective communication with creditors and **debt collection agencies** is vital. Knowing your legal rights under the Fair Credit Reporting Act (FCRA) is essential when interacting with these entities. This understanding empowers you to communicate your positions clearly and defend against incorrect **credit reporting errors**. If you opt to **negotiate with creditors**, make sure to maintain clear and documented communication, outlining your proposal while being ready to discuss payment plans or settlements. Documenting these interactions can also help strengthen your case when disputing any inconsistencies later on.

Disputing Credit Report Errors

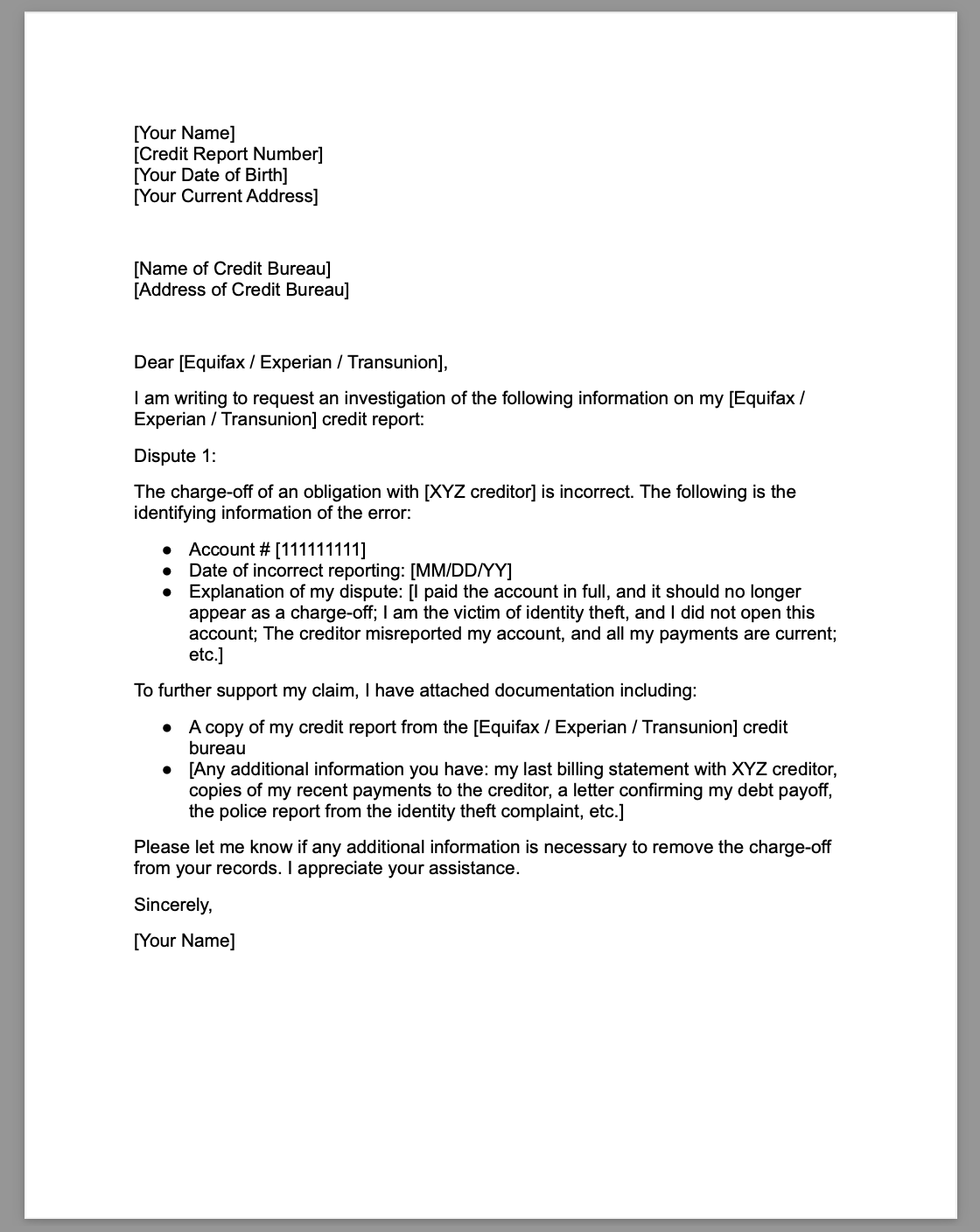

One of the most effective methods to remove inaccurate items or **credit reporting mistakes** is through disputing the errors directly with the credit reporting companies. When your **credit report** reveals inaccuracies, especially errors derived from collection accounts, writing well-structured **dispute letters** is a proactive approach. Be sure to include documentation supporting your claim, including payment records or settlement agreements. This evidence significantly enhances the effectiveness of the dispute process.

Furthermore, consider requesting **credit report monitoring** to keep a close eye on changes and updates to your accounts which can further assist in maintaining **credit report accuracy**.

Effective Strategies for Credit Repair

Repairing your credit and removing negative items, including paid collections, is achievable through specific strategies. Focus on **credit score improvement strategies** like ensuring timely payments, managing your credit utilization ratio, and engaging in **debt validation letters** to ensure that debts reported are legally validated by the collection agencies.

Credit Counseling for Financial Recovery

Seeking **credit counseling** services can be another pivotal step in your credit repair journey. A credit counseling professional can offer personalized strategies tailored to your unique financial situation. They can help you manage collection accounts more effectively, suggesting ways to prevent future financial complications. Working with professional credit consultants often aids in understanding available resources, shaping your personalized strategy for **financial recovery**. Therefore, consider scheduling a session with a reputable professional who can guide you through the financial service maze.

Negotiating with Creditors for Settlements

**Negotiating with creditors** is vital for settling debts effectively and potentially having them removed from your credit report. When proposing a settlement, be realistic about your ability to repay while still striving for a manageable resolution. Prepare a written proposal that outlines your financial situation and specifies an offer significant enough to prompt a response. Often, settling debts for less than the outstanding amount is possible, and agreeing upon these settlements might also lead to collections being marked as “settled,” which could improve your credit standing over time. Don’t forget to request that creditors report the account as “paid in full” or “settled” to credit agencies once negotiations are over.

Best Practices for Handling Collections

To **keep your credit clean** and manage collection accounts effectively, develop good habits throughout your financial journey. This approach involves budgeting for timely payments, understanding your **credit scores** and **credit utilization ratio**, and regularly checking your reports for any discrepancies. By routinely monitoring your credit history and budgets, you foster proactive measures for avoiding future collections and ensuring all unresolved accounts are addressed in a timely manner. Understanding the credit landscape further strengthens your ability to implement **credit rebuilding tips** as necessary.

How to Remove Inaccuracies from Your Credit Report

The path towards correcting your credit report is vital for improving your overall creditworthiness. When inaccuracies arise, addressing them systematically enhances your financial profile considerably. It’s essential to follow specific steps to ensure an effective process for **removing inaccuracies**. This involves identifying all errors, gathering appropriate documentation, and utilizing **writing effective dispute letters** to challenge inaccuracies in the same structure provided previously.

Timelines and Procedures for Disputes

Knowing the timeline for disputes is key. After sending a **dispute letter**, the credit reporting companies have 30 days to investigate your claim and verify the information with the creditor. If they find the item isn’t accurate, they will remove it, leading to a heightened **credit score**. Understanding this timing allows individuals to manage their expectations and act quickly when inaccuracies occur, ensuring a clear and correct credit report more rapidly.

Using Technology for Credit Monitoring

Modern technology has greatly aided in the realm of credit management. Utilize apps and online services for **credit report monitoring** that help keep track of changes and updates. These tools often provide alerts when unexpected items appear, enabling proactive measures to contend with potential issues before they escalate. The use of these services greatly enhances your financial recovery efforts by facilitating ongoing **credit management**.

Key Takeaways

- Request and review your credit report regularly for inaccuracies.

- Understand your rights regarding debt collection and FCRA regulations.

- Negotiate with creditors to settle debts effectively.

- Make use of professional credit services and counseling for tailored advice.

- Utilize technology for consistent credit report monitoring.

FAQ

1. What types of collection accounts can be removed from a credit report?

Collection accounts that have inaccuracies or were paid but still listed as outstanding can often be disputed. If there’s proof that the account was paid or settled, it can either be removed or marked to reflect its current status.

2. How long do collections remain on my credit report?

Paid collections typically remain on your credit report for up to seven years from the date of the original delinquency. However, they can be removed through dispute processes if they inaccurately reflect your payment history.

3. Is it possible to negotiate after paying off a collection?

Yes, you can negotiate for the removal of a collection account even after it has been paid. It’s advisable to request a “pay for delete” agreement with the collection agency before fulfilling payment to ensure it gets removed from your report.

4. What are the key steps in writing effective dispute letters?

When crafting effective dispute letters, clearly outline the account in question, state why the information is incorrect, and attach supporting documents. Keep your letter concise and formal to convey your concern effectively.

5. How can I improve my credit score rapidly?

Improving your credit score faster involves paying down existing debts, ensuring timely payments, resolving inaccuracies in your credit report, and minimizing new credit inquiries. Regular monitoring is also key to staying on top of your progress.