Effective Ways to Remove PMI and Achieve Mortgage Freedom in 2025

Understanding PMI and Its Impact on Homeowners

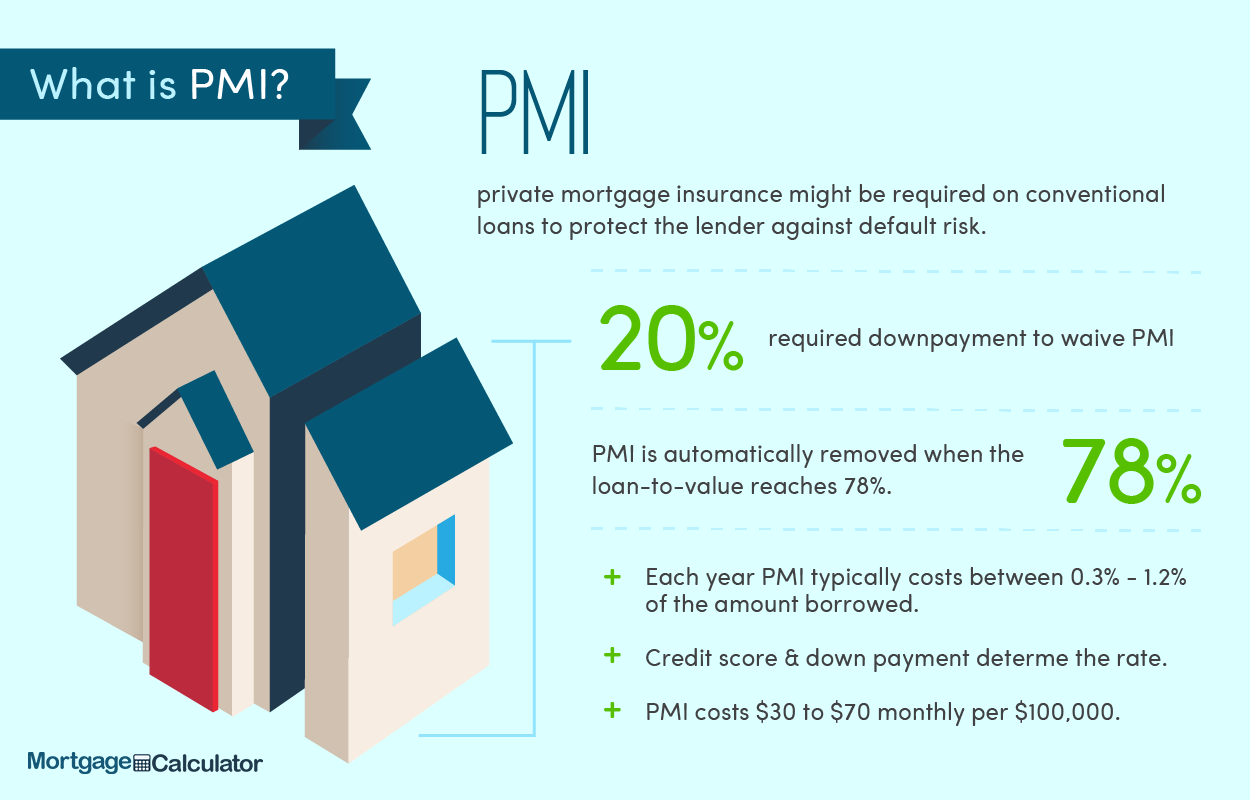

Private Mortgage Insurance (PMI) is a crucial aspect of home financing, especially for borrowers who are not able to provide a 20% down payment. PMI serves as a safeguard for lenders against potential defaults on loans. However, while it protects the lender, it can be a considerable extra expense for homeowners. Knowing “**how to remove PMI**” effectively can lead you towards mortgage freedom, which is a significant goal for many homebuyers. In this section, we’ll explore the basics of PMI, its necessity, and ways it affects mortgage payments.

What is PMI and Why is it Required?

PMI stands for Private Mortgage Insurance, which financial institutions require when homebuyers borrow over 80% of the home’s value. This insurance acts as a risk management tool, ensuring lenders protect themselves against borrower defaults. Understanding the need for PMI is essential for homebuyers. Without it, obtaining financing for homes would be challenging for those who can only afford smaller down payments. **Eliminate PMI steps** often start with understanding how long you will have to pay it and what financial actions you can take to remove it in a timely manner.

Identifying PMI in Your Mortgage

To deal with PMI effectively, the first step is identifying if it’s part of your mortgage to determine if the **pmi removal techniques** are applicable. Look at your mortgage statements; it is typically listed as a separate fee. Once identified, assess the overall cost of PMI and how it affects your monthly payments. Understanding this information can empower you in negotiating or strategizing for **effective PMI elimination** options.

Common Misconceptions about PMI

There are several misconceptions about PMI. Many homeowners believe they can never escape it, which is not true. With the right understanding and **pmi reduction strategies**, homeowners can eliminate PMI and save on monthly mortgage payments. Being unaware that PMI payments can stop once they reach 20% equity can lead to prolonged unnecessary expense burdens.

In conclusion, knowing the specifics about PMI and its role can lead to more informed financial decisions regarding mortgage payments. As we move forward, let’s explore actionable strategies like PMI solutions and **action plans for PMI removal** that can help you save money effectively.

Strategies for Effective PMI Removal

Removing PMI is not just about waiting for enough equity to accumulate. There are strategic ways to expedite the process. This section unveils just how you can forge towards mortgage freedom through **pmi optimization tips**, ensuring you’re taking the most efficient and effective path possible.

Refinancing Your Mortgage

One of the best practices for PMI removal is mortgage refinancing. By refinancing your mortgage, particularly when market rates drop, homeowners may be able to eliminate PMI altogether. This involves reassessing the value of your home, and if this exceeds the amount owed on your mortgage by a certain percentage, you could secure a new mortgage without PMI requirements. Refinancing not only aids in PMI elimination but may also lower interest rates and improve overall financial standing.

Increasing Equity through Additional Payments

Making extra payments on your mortgage principal is another solid technique to achieve PMI removal. By adhering to a payment plan that prioritizes paying down your loan balance faster, you can build equity quicker. This not only moves you closer to the 20% threshold that typically triggers PMI removal but also reduces the total interest paid over time on the mortgage.

Home Value Appreciation and Market Analysis

Monitoring the real estate market for home value appreciation can greatly affect PMI status. If your home appreciates significantly, you may qualify for PMI removal sooner than expected. Regularly checking your home’s value against the course of the market will guide you in identifying the right time to request the PMI removal process initiated by your lender, ensuring you maximize the **benefits of PMI removal**.

Conclusively, effective PMI removal strategies can mean significant savings and progress toward financial freedom. As we proceed, our next focus will be on PMI management tips—essential knowledge to maintain your financial health while navigating home financing.

PMI Management Tips for Homeowners

Managing PMI effectively requires a proactive approach. Homeowners play a crucial role in the **process of removing PMI**. In this section, we emphasize practical strategies and insights that can help streamline processes to reduce and eventually eliminate PMI.

Understanding Your Lender’s PMI Removal Requirements

When considering PMI removal, it’s vital to understand your lender’s specific requirements. Each lender has unique criteria for when PMI can be canceled. Familiarize yourself with these terms as documented in your mortgage agreement. Often, simply reaching the necessary equity can be enough, but some lenders might require an official appraisal. Knowing what is expected ensures you can act swiftly and effectively when it’s time to proceed with **pmi troubleshooting**.

Regular Monitoring and Documentation

Keep careful records of your payments, current mortgage balance, and communicated updates regarding home value. By maintaining a tracker, you can justify your case for PMI removal more swiftly than if retrospection is required. This ongoing documentation process ensures that you monitor the **pmi impact** effectively on your financial trajectory, creating a well-documented case for the lender when making the removal request.

Open Communication with Your Lender

Establishing a solid communication line with your lender is paramount. Regular dialogue ensures that you’re not caught off guard by unexpected policy changes that might affect your mortgage terms. As you strive to achieve a **PMI-free environment**, having this open communication ensures you maximize your efforts—whether seeking advice on how to assess PMI, documenting your payments, or understanding any necessary PMI removal protocols enforced by your lender.

In summary, efficient PMI management is about being strategic, proactive, and thoroughly informed. Now let’s explore how to adopt an action plan that can contribute to successfully removing PMI from your mortgage.

Creating an Action Plan for PMI Removal

Creating a strategic action plan is essential for homeowners looking to move towards removing PMI. This section lays down steps and innovative tactics that can act as catalysts for eliminating PMI swiftly and effectively.

Setting Clear Financial Goals

Your action plan should begin with setting clear financial goals. Examine how quickly you want to eliminate PMI. Having end goals will not only keep you focused but also foster a disciplined approach towards managing your budget and equity-building tasks. This clarity is critical in undertaking **pmi avoidance strategies** that will guide your path toward effective mortgage management with reduced costs.

Engaging with a Financial Advisor

Consulting with a financial advisor can greatly streamline your plan by providing tailored advice. A qualified expert can offer insights into the market and your financial situation that will equip you with the best strategies for your particular case. They can help develop a comprehensive roadmap to remove PMI, assess the cost-benefit of refinancing, and explore the best practices for eliminating PMI that align with your unique financial goals.

Utilizing PMI Tools and Resources

Take advantage of PMI reduction tools available to homeowners. These resources will inform the complexity surrounding PMI management and offer strategies for effective removal. Workshops on PMI awareness, online classes, or online calculators for PMI repayment can empower you with knowledge and skills. Being well-informed alters your perception of PMI from a hurdle to something manageable—significantly lowering any emotional strain and **pmi impact reduction**.

In conclusion, having a well-thought-out action plan helps pave the way to a future without PMI, ultimately leading to significant financial freedom. As we wrap up this resource, let’s answer some common questions about PMI removal to further enhance your understanding.

FAQ

1. How can I check my PMI balance?

Your PMI balance can typically be found in your monthly mortgage statements. It is usually listed as a separate line item, providing clarity on the amount you are paying. Additionally, incorporating **pmi assessment techniques** regularly will aid in tracking your payments, helping to inform you when you can initiate PMI removal efforts.

2. What happens if I don’t remove PMI?

If your PMI is not removed after reaching the requisite equity, you could continue paying unnecessary expenses. Without taking steps to reduce PMI, the impact on your overall budget can be significant—restricting your financial flexibility and delaying truly **mortgage-free** living.

3. Can I remove PMI if my home value has increased?

Yes! If your home value rises significantly, you might qualify to remove PMI based on your increased equity percentage. Providing an updated appraisal to your lender can facilitate **pmi change management** processes, thereby skipping the expense if your equity exceeds the required threshold.

4. Is refinancing the only option for removing PMI?

Refinancing is a potential option but not the only one. Other strategies like making additional principal payments or engaging with your lender about value appreciation could benefit your goal to eliminate PMI efficiently. It’s worth exploring multiple **pmi cutting methods** to find the one that aligns best with your financial situation.

5. What are the long-term benefits of removing PMI?

Removing PMI leads to lower monthly payments, affording greater financial freedom and allowing money to be directed to savings or other investments. Establishing a **pmi-free environment** can also significantly improve your budgetary flow and assist in achieving long-term financial goals.

6. Are there specific PMI removal programs available?

Yes, certain government programs provide guidelines on PMI removal, like the Home Affordable Refinance Program (HARP) which enables homeowners to refinance and eliminate PMI under specific conditions. Checking eligibility can yield positive benefits towards effective PMI elimination.

7. How can I create a sustainable strategy for mortgage management post-PMI?

Developing sustainable home financial practices post-PMI encompasses budget planning, maintaining communication with lenders, and consistent market research. Preparing for **long-term sustainability without PMI** encourages informed decisions that maintain overall financial health while ensuring project success in future housing endeavors.